Your first job

So you are 20 plus and after finishing your study you land

up in your first job (may be in your dream company) happily. Soon your first

salary is credited into your account making you super happy. As the time passes

you start noticing the provisional income tax being deducted from your salary

and in a way you get frustrated. You think you have just started earning and a

considerable amount is going directly to the govt. Also the money you get you

prefer to spend on various activities of your interest and the entire

amount is spent very soon. Correct? And then you eagerly await for the next

salary… where one should realise the importance of saving some amount regularly.

(image source google images)

Why saving is important?

Everything is going well for now. Now think about your needs

as you grow further, yes, up to your retirement. Are you sure that the economic

condition would always remain the same? Are you sure that no unforeseen

circumstance would happen in your life? Are you OK with the current deduction

of tax in your salary? No, right? That’s why saving some portion of your salary

becomes important, and it’s not difficult if you just apply some limit to your

(unnecessary) expenses. It is said that one should set aside about 20-25% of

your salary aside for saving. Not a big deal right?

There are various avenues of saving money like fixed

deposits, PPF, NSC etc., one of them is equity mutual funds. I’ll explain what these

are, how to invest and its benefits in simplest words.

Mutual funds

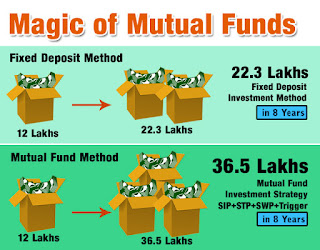

Think about fixed deposits. You give money to banks, they

promise a fixed interest rate and give you principal and interest at the time

of maturity. Everything is certain in this, but what if you come to know you

could earn a lot more if you had invested the money through mutual funds?

There are several businesses going on in the country. They

need money to grow. They can get money by borrowing from banks or public on a

fixed rate, or they can offer you (the money holder) to be the part of their

business and promising the share in the profits they earn, instead of repaying the loan.

Mutual funds are headed by experienced people (called fund

managers) who know which business is going to be profitable and for how much duration

(by their calculations and experience, though it’s not that certain but they

are professionals). These mutual funds (called equity mutual funds) become part

of the businesses they choose based on their outlook, and become shareholders

in them, by giving them the money. So when the company grows their share amount also grows in equal ratio

and profit is gained, which is distributed to the investors (like you). No, this

is not always certain, but no pain, no (additional) gain, right? From past

experiences, it is seen that they have returned 50% and more as well (though nobody can claim

certainty about future) in some durations.

(image source google images)

As a tax saving instrument

That was about saving. Lets see how good it is as a tax saving instrument. Other tax saving deposits need you to lock in your money

from five years to 15 years. But the tax saving mutual funds called Equity

Linked Savings Scheme (ELSS), offer good returns plus the lock in period of

only three years. So you CAN take the money out of them after three years only

along with returns with no upper limit. So high returns plus tax savings is a double benefit isn't it?

(image source google images)

Handling risk

No one can be sure how market will behave therefore there is

risk involved in investing in equity mutual funds. However as a general

observation, from medium to long term (three years and more), almost all mutual

funds offer good returns. Any return above 10% can be considered good. When the

market is going down, wise fund managers either opt out of investments or buy

more shares at low prices as they deem fruitful so they earn even more when the

market bounces back.

(image source google images)

Experience suggests that given the scenario one should not

completely rely ONLY on mutual funds despite of offering good prospects. Distribute

your money in all the saving instruments including mutual funds (called

diversification) to reduce the risk of loss.

How to choose and invest in equity mutual funds?

There are two ways to invest- one is through a financial advisor and

other Directly through the mutual fund. For the first method the advisor takes

his fee and suggests how much to invest and where? Other method relies on the

investor, who does research on his own. That’s not a huge effort. There are

plenty of sites to help like valureresearchonline, moneycontrol etc. By

investing in Direct plans the involving costs is less thus the return is

higher. Both the methods involve an initial KYC process and then one can invest

the amount one wishes. There is a good option in which some amount can be

invested each month to the mutual fund, called Systematic Investment Plan

(SIP).

There is a lot to cover in this topic but I believe this

would have helped the reader to understand the mutual funds. More to come!

No comments:

Post a Comment